To set up a Direct Debit (DD) payment on the Finanças website, please watch our 'How to...' video below or follow the step-by-step instructions below.

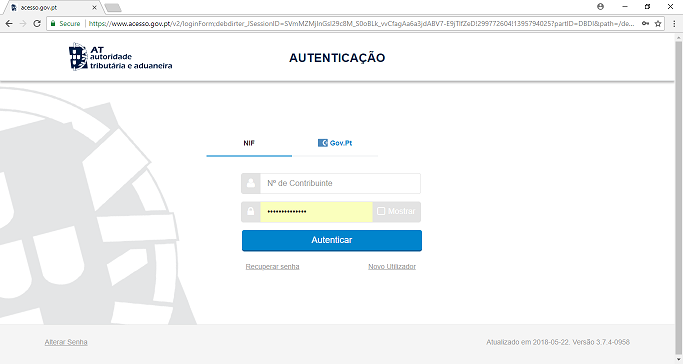

- Enter your fiscal number and password to access the Portal das Finanças and press ‘Autenticar’

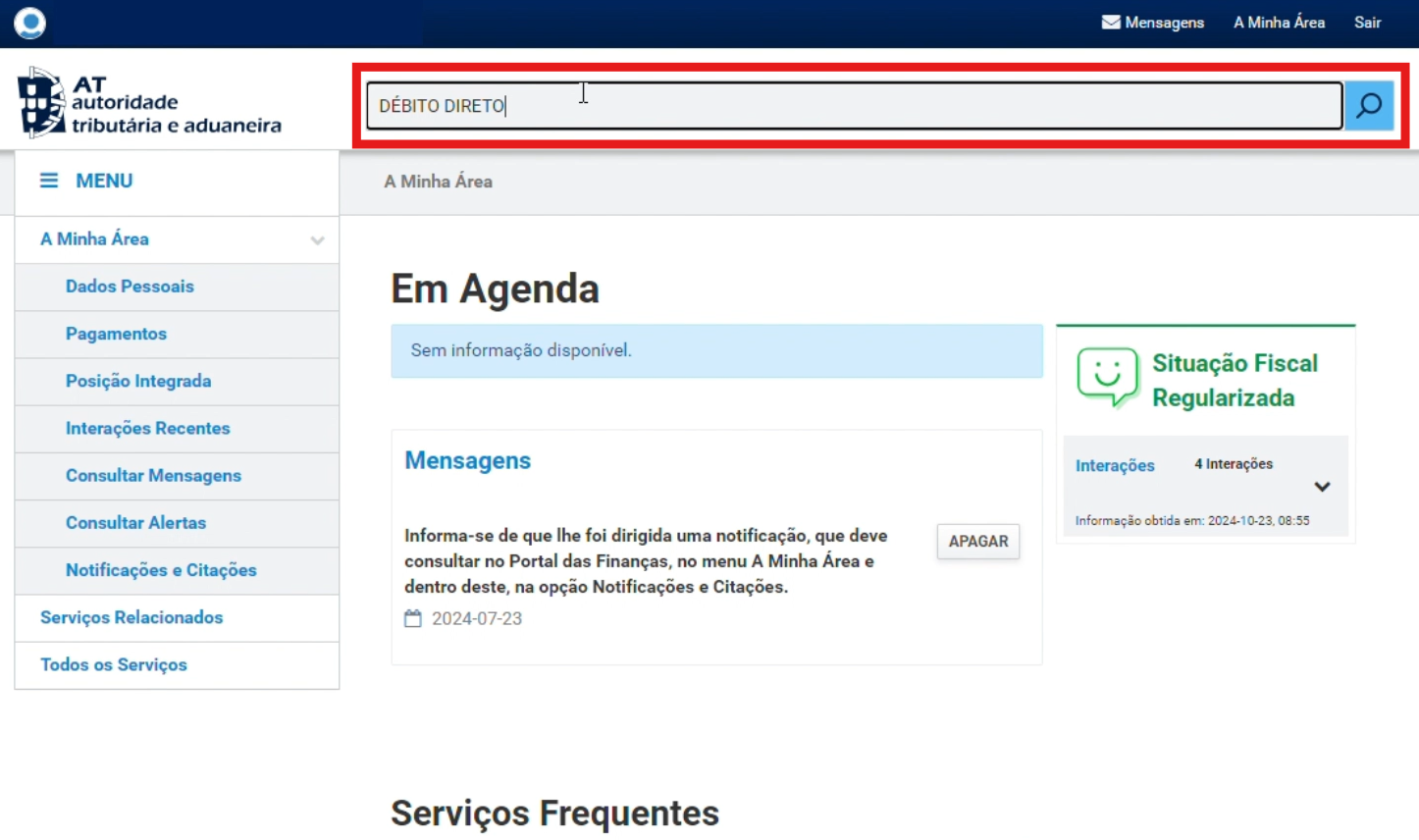

- Then type ‘Débito Direto’ in the search bar

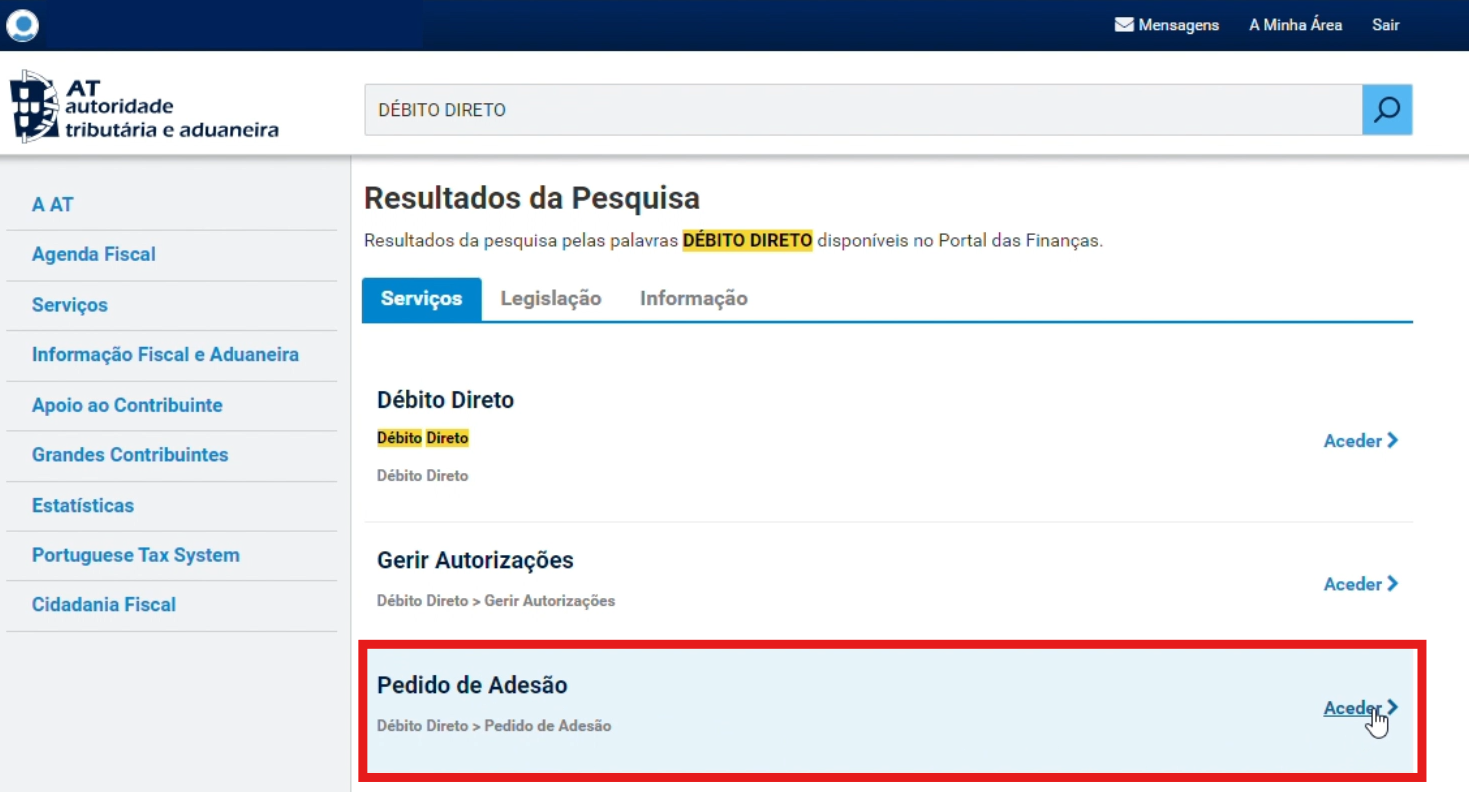

- Click where it says ‘Pedido de Adesão’ and afterwords where it says ‘Novo Pedido de Adesão’

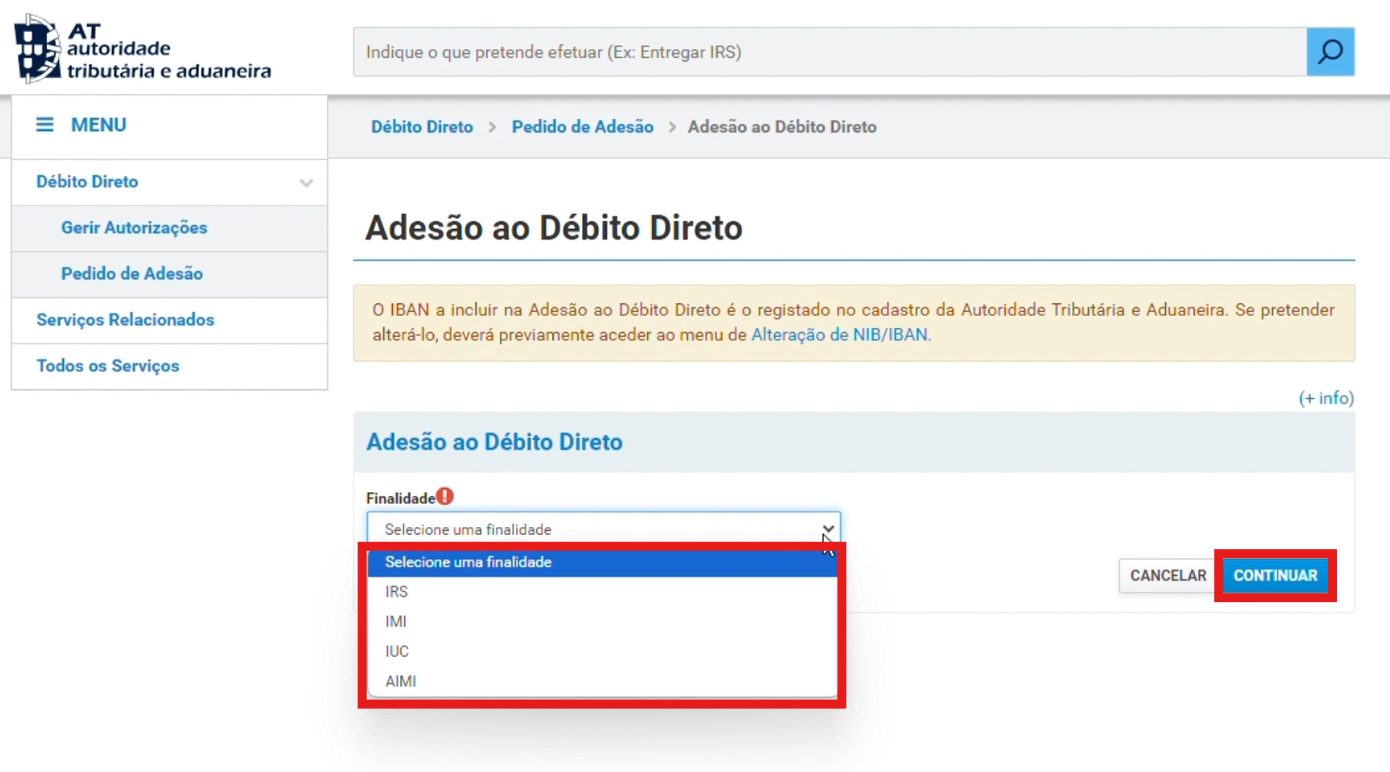

- Choose what you want to pay in ‘Finalidade’: IRS; IRC; IMI or IUC

Check your bank details and choose ‘Continuar’

If you want to change the IBAN, you can do this to click on the link where it says ‘Alteração de NIB/IBAN’. Make sure you fill in the NIB/IBAN without any spaces in between

Select the ‘Tipo de Pagamento’ (type of payment): - Recorrente (recurring) or Pontual (singular)

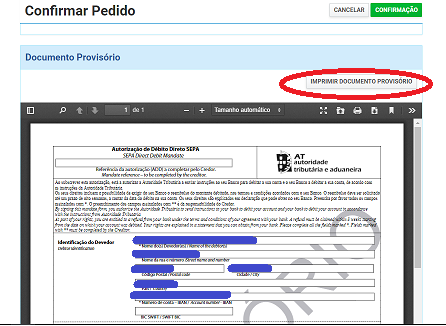

For example, imagine that you have chosen the IUC payment option; this box should appear with your bank details and the authorisation in your name. Press ‘Confirmação’ then scroll down to print the document and press ‘Imprimir Documento Provisório’.

Please note that the document you print is proof that you have set up a DD, not proof of payment of the associated tax. You should keep this document in case there is any problem with the eventual payment, in order to prove that you set up the DD and the date on which it was confirmed. You will then receive a confirmation e-mail from Finanças, telling you when the DD payment will be taken from your account.

Disclaimer

afpop considers in good faith that all the information provided is true and accurate after having endeavoured to so confirm to the best of its ability. However, afpop is not qualified to render any technical advice, recommendation or information, nor is it under any legal duty to do so. Therefore, afpop declines any responsibility for possible damages arising directly or indirectly to members or non-members from alleged incorrect or misleading advice, recommendation or information and strongly advises all members to seek always the services of qualified practitioners and/or professionals for any technical matters, such practitioners and/or professionals being exclusively responsible for possible damages arising from their activity, including their technical opinions that may be inserted in our publications.